Between learning homebuying jargon and figuring out debt-to-income ratios, shopping for a home in 2019 can be a challenge, especially for a first-time buyer.

For millennials, preparing to purchase their first home can be particularly tough, considering the immense learning curve and the sheer number of properties that seem to be out of reach. And high hopes for homeownership can quickly turn into disappointment if your budget doesn’t stretch as far as you’d initially predicted.

So to help others who may be navigating first-time homeownership, we surveyed over 1,000 millennials about their experiences before, during, and after purchasing their first home. How long do millennials take to close on their first home, and how do their purchase expectations match up to reality? Read on to discover our findings.

Reasons for buying (or delaying) homebuying

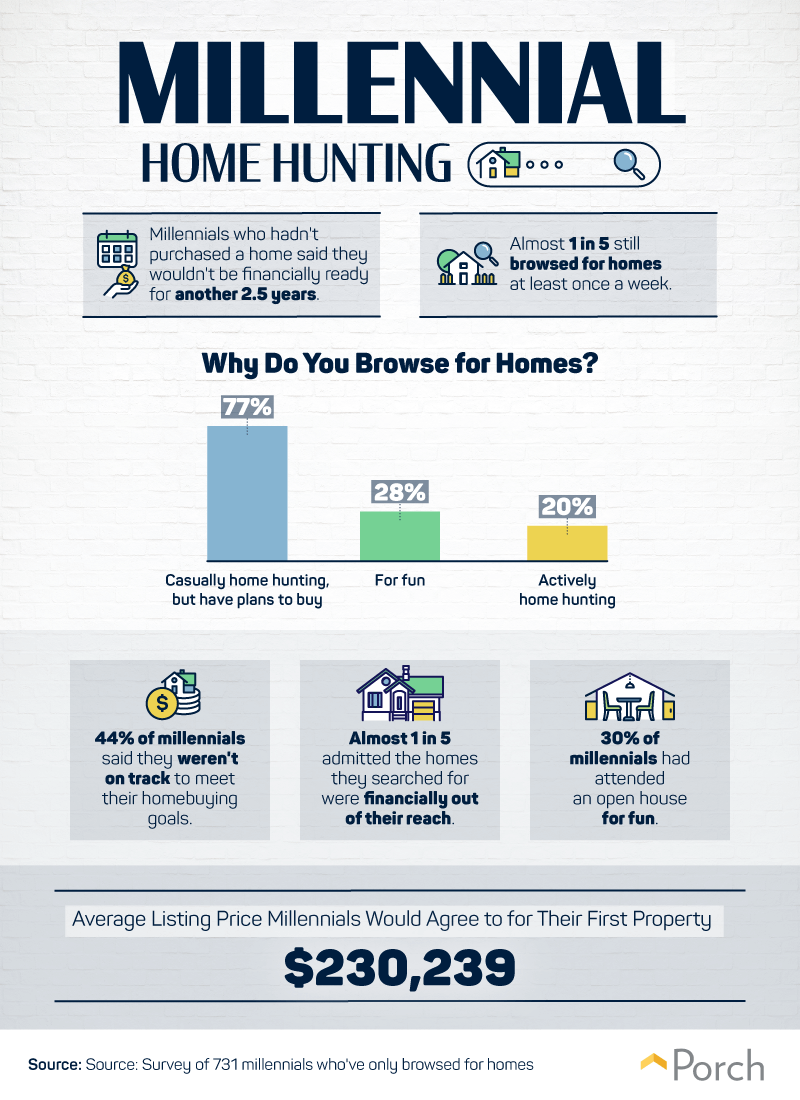

Homeownership tends to be a pillar of adulthood, yet many millennials are waiting later than their parents did to buy their first home. A major reason for holding back points to financial struggles: 44 percent of millennials felt their homebuying goals were not currently attainable, with respondents estimating they wouldn’t be ready to buy a home for an average of two and a half more years.

The home buying process has been influenced by the elimination of agents in favor of digital platforms to expedite the house hunt. The increased accessibility has opened millennials up to approaching home buying more casually than in the past. Instead of calling an agency, buying a house is now as simple as opening a web browser and digitally window shopping for properties. Whether they have the money for a home purchase, interest in homeownership is there, with nearly 1 in 5 millennials visiting house-hunting websites weekly. Thirty percent of millennials even reported going to open houses for fun.

While respondents were willing to agree to an average listing price of around $230,000, that value can be stretched further in areas with lower costs of living rather than in notoriously inflated real estate markets such as Los Angeles, San Francisco, and Seattle.

Homebuying costs and commitments

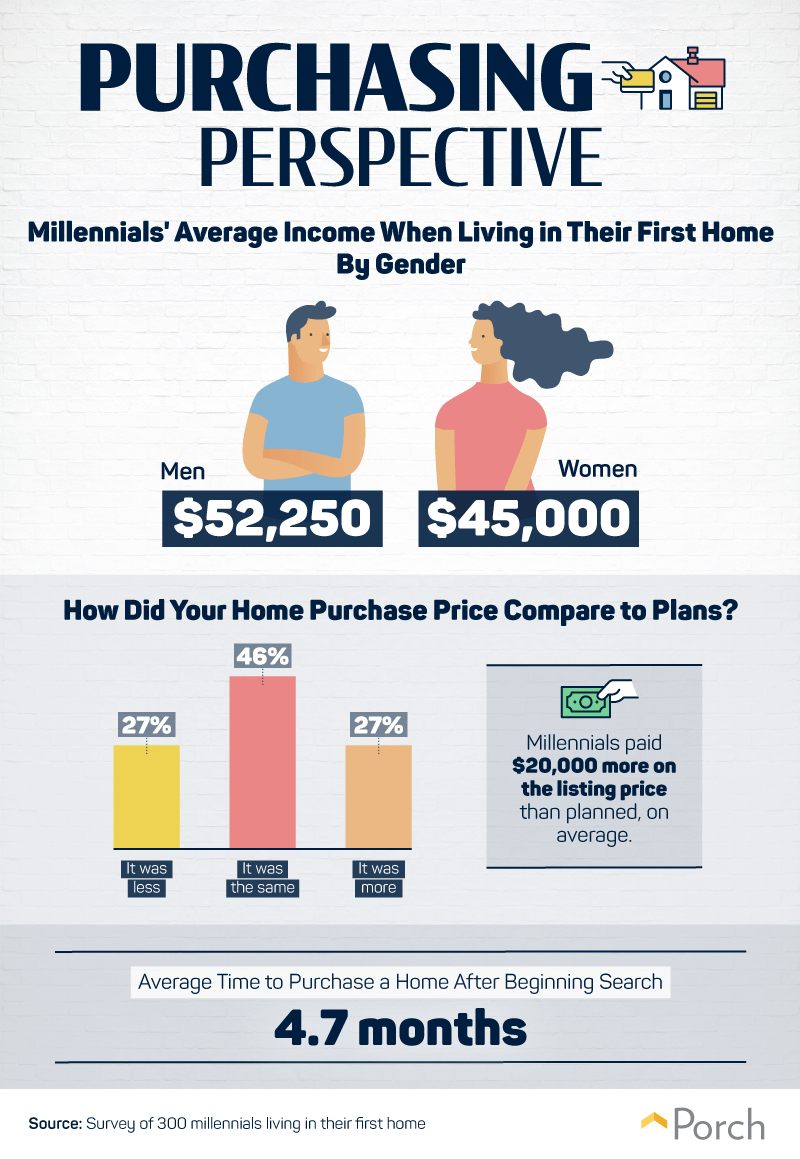

Often, demand for desirable neighborhoods and cities causes bidding wars between hopeful buyers, driving the cost of a home way above its market value. The 27 percent of respondents who reported paying more than their home’s listing price spent $20,000 more than they’d planned, on average.

Factoring in some headroom for negotiation is key to maintaining your financial interests and acquiring the home you want; however, homebuying can be delayed by the sheer amount of time the process takes.

With the average respondent’s home search lasting nearly five months, the experience can seem dragged out. A good tip is to make sure you have all the documents to submit for your mortgage loan and any qualifying paperwork for employment ready to go. Much of the delay in homebuying comes from the back and forth with the bank, so be proactive with how much evidence you supply.

Relationships and homebuying

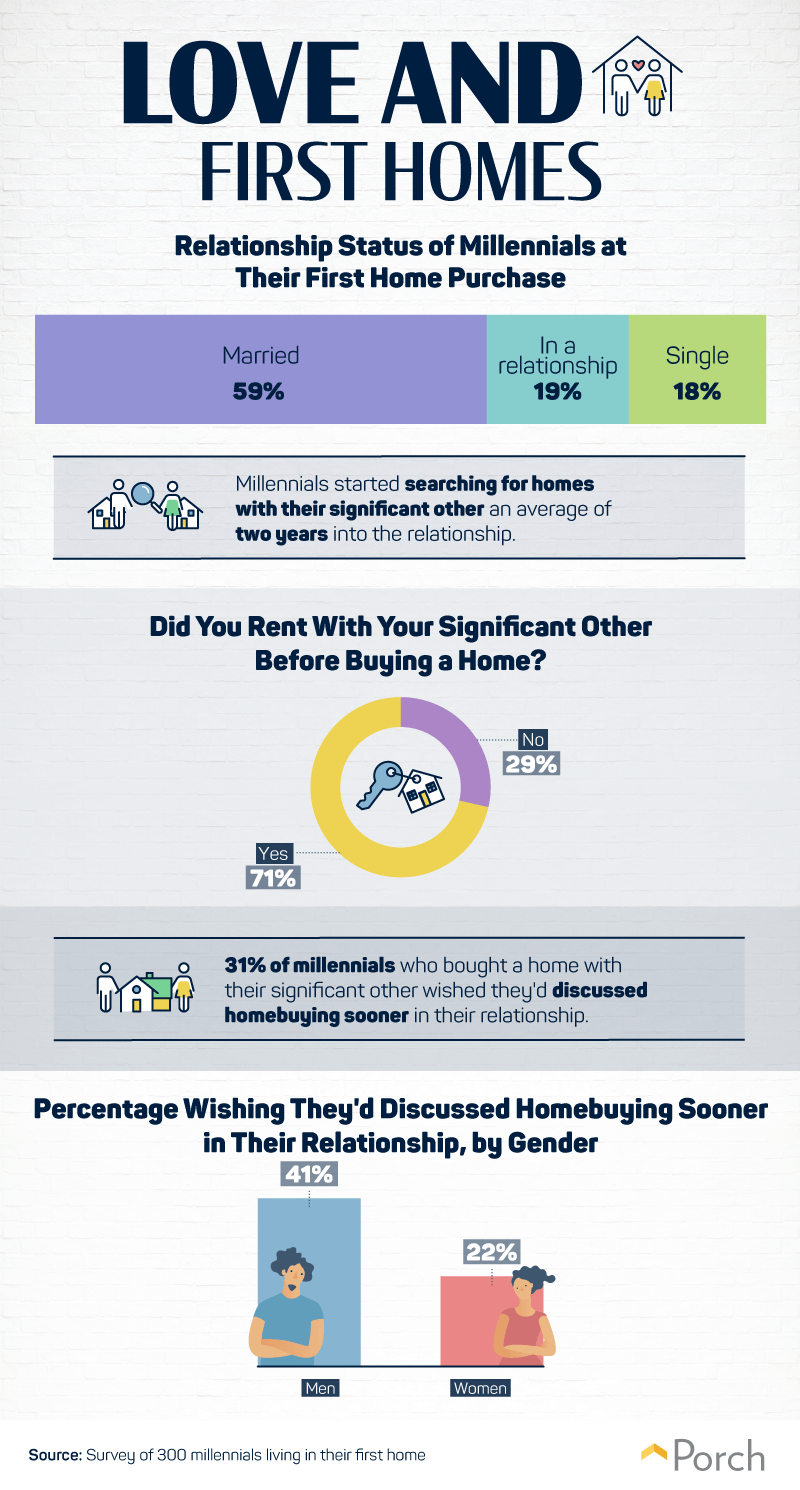

Nearly 3 in 5 millennials living in their first home were married. However, almost 20 percent of millennials in a relationship also purchased a home together—showing that more and more nonmarried couples are choosing to cohabitate.

Plunging into homeownership with a partner may seem hasty, especially if you are unmarried. But while renting may be a good opportunity to experience living with a significant other with less risk, 29 percent of millennials didn’t choose to rent first before buying a home with a significant other.

Overall, homeownership is an important conversation between partners, and 41 percent of men and 22 percent of women regretted putting off the discussion for too long, so don’t postpone longer than you feel is right.

Modern remains popular, tiny living on the rise

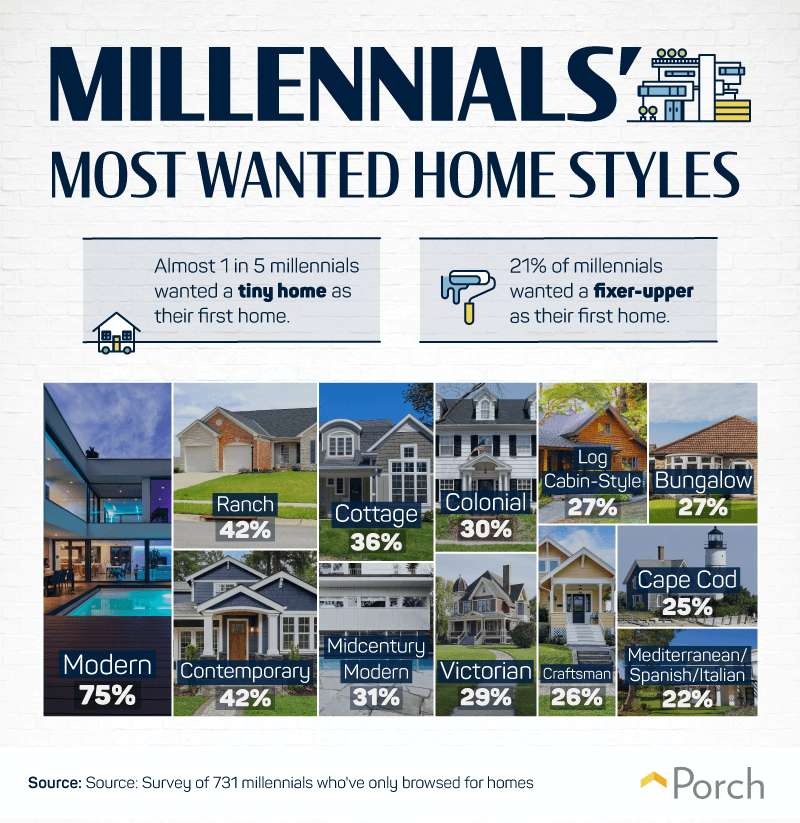

Younger generations are veering away from baby boomers’ beloved McMansions, favoring a smaller residential footprint. In fact, nearly 1 in 5 respondents wanted a tiny home as their first property. Tiny home supporters rave about their low costs and flexibility, making them a popular first-home option for many.

And while three-quarters of respondents most wanted a modern home as their first property, some first-time homeowners are opting to pour their hearts into a renovation project, with 21 percent of respondents citing a fixer-upper as their preferred housing type. Taking a chance on a rough-around-the-edges property can be extremely rewarding, especially for millennials looking to save money and land a home in a neighborhood that might normally be out of reach financially.

Buying your first home: Tips for millennials

The homebuying process doesn’t have to be met with regret at the end. Staying informed about your financial limitations and researching the local housing market can give you confidence that you are working toward your homeownership goals.

Ask questions to your real estate agent, loan representative, or friends who own properties. And know the latest real estate hot spots so you can aim your house hunt in areas that lead to lucrative buys.

But before you go to an open house, make sure to head over to Porch to find home improvement comparisons and renovation experts to fit your homebuying needs.

Methodology and limitations

We used Amazon Mechanical Turk to survey a total of 1,031 millennials through two separate surveys. The first survey consisted of 731 millennials who had not yet purchased a home, and the second survey consisted of 300 millennials who had purchased a home. Of all respondents, 54 percent were women, 45 percent were men, 1 percent identified with a nonbinary gender. The average age of respondents for both surveys was 30 with a standard deviation of five years. The data had a 3 percent margin of error for millennials. To be considered in our data, respondents were required to complete the entire survey and pass an attention-check question in the middle of the survey. Participants who failed to do either of these were excluded from the study.

In visualizations showing quantitative averages, we removed outliers or used medians so that the data were not exaggerated.

In the visualization of millennials’ relationship while in their first home, groupings for “widowed,” “divorced,” and “engaged” were removed. Additionally, “married,” “in a relationship,” and “single” refers to millennials’ current status in their first home. Some respondents may have had a different relationship status when they went through the homebuying process.

Fair use statement

Are you a first-time homebuyer? There are many things to consider, and we hope this research gives you an upper hand in your home search. Please mention us when citing our survey, and share this research for noncommercial uses only.